Programming & Tech

Writing & Translation

Design & Creative

Admin & Customer Service

Digital Marketing

Engineering & Data Science

Image, Video & Music

Business & Lifestyle

Browse by Category

Get up to $300 bonus now! Click Here!

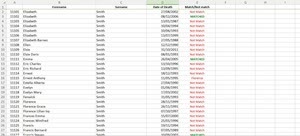

Matching Task

portfolio

Matching two different excel file.

Share this work sample

copy link

Similar portfolios

Microsoft Excel Excel from Beginner to Advanced CertificateMicrosoft Excel Excel from Beginner to Advanced Certificate

Certificate of CompletionThis is to certify that Caroline Morfitt successfully completed 7.5 hours of Microsoft Excel Excel from Beginner to Advanced online course on Nov. 24 2019Warrick Klimaytys, Instructor&

Udemy# Be AbleCertificate number: UC 5MOZ9C71

Certificate url: ude.my/UC 5MOZ9C71

Excel VBA Microsoft Excel

Caroline M.

Profile N/A

Providing data bank

For reserving my client rights, I just uploaded a picture from one slide.

Data entry Microsoft Excel

Mohammad sadegh P.

Profile N/A

The latest sanctions expansion on the Russian financial sector seeks to disconnect her three largest banks from the global payment networks. Targeted banks include the state owned Sberbank. In general, Sberbank is Russia’s top lender. Other banks are the Russian Agricultural Bank and the Credit Bank of Moscow.

This report comes following a European Union agreement. Ursula von der Leyen (the EU president) said that this sanction will hinder most systemically vital banks to the country’s financial system. The sanction also aims to shrink Putin’s wage destruction ability.

Several Russian major banks like the VTB (second largest bank) have already pushed off SWIFT. Nonetheless, the European Union has slowed confiscating banks like Sberbank that handle energy transactions. Experts now believe this move might mean less impact since other sanctions now seek to phase out Russia crude oil imports within six months.

The Sberbank accounts for about 37% of the Russian financial system. Thus, Russia's banking disconnection from SWIFT is a massive blow to her fragile economy. Russia is increasingly facing cut off from their finance mainstream.

SWIFT is not a transfer system, but it generates messages to authorize and support payments. Thus, it is a vital factor for the easy functioning of financial institutions. The system processes more than 40 million messages daily.

The EU president explained that disconnecting Russian banks from SWIFT would help solidify Russia’s total isolation and suspension from the global system. However, experts contemplate that Russia might seek refuge in SWIFT alternatives.

What's the Impact on Russian Banks?

Russia established the SPFS (System Transfer of Financial Messages) in 2014. It is the country’s independent ruble based exchange system. They also have access to other options like the CIPS (China’s Interbank Payment System). In any case, the SPFS is the most popular transaction system for most hit banks in Russia.

It is also a popular option for about 52 foreign organizations in more than 12 countries. Nevertheless, the Russian Central Bank has refrained from naming other users. Putin’s administration has persuaded several emerging economies to opt for the SPFS system. The most targeted countries include South Africa, China, India, Russia, and Brazil.

Anton Siluanov (Russian Finance Minister) warned these countries in a BRICS ministerial meeting to learn from the sanctions they face in the world financial systems. He advocated speeding up their own financial messaging system and payment systems integration.

Furthermore, China and Russia are working together to establish a connection between their financial systems to facilitate Asian payments. Other reports indicate that China is still purchasing cheap oil from Russia despite the threats of breaking sanctions.

Final Remarks

The crisis in Ukraine is worsening, and more people have lost their livelihood. Hence, the European Union is stringent about imposing severe sanctions on Russia to help curb the invasion. Sanctions play a crucial role in keeping nations compliant with human rights.

Nonetheless, this approach faces challenges from countries like China that are sidelining Russia. For that reason, the European Union has warned to impose intense penalties on Russia’s counterparts.

Microsoft Excel Financial Analysis

Hillary O.

Profile

The customer requested sorted Czech/English vocabulary by the alphabet, category, and use.

Within a few days, the task was completed in an excel file with hundreds of words.

Translation Microsoft Excel

Vojtěch V.

Profile

Thank you taking interest and looking into my Profile.

I am a FAST TYPIST in both English and Urdu. I have 25+ years of experience in this field. I have been providing my services to Government, Semi Government, Autonomous Bodies and Schools for their simple typing work and financial statements in English and Urdu with 100% accuracy. I am familiar with all types of office correspondence and know well English and Urdu Typing Procedure and Styles. Details of my services are as follows:

My Services:

Typing In English/Urdu

Office Correspondence

Organization’s Records

Accounts

Accounting Reports

Statements

Budget

School Question Papers

Helping Guide for Students

News Paper Articles

Surveys and Questionnaires

CVs and Resumes

Filling Applications Form

Hand Written Scripts

Scanned Image to MS Word, MS Excel, InPage.

Retyping of PDF to MS Word, MS Excel, InPage.

Graphic Designing

Invitation Card

Birthday Card

Ceremony Card

Back Ground Remover & Replace

I assure you that the Project provided for typing will be delivered in time and accurate.

I will be very happy to work for you. Any queries please In Box me.

I provide Prompt Service and in time Delivery to my clients.

Best Wishes and wish to be your Virtual Assistant

Naeemuddin

PDF Microsoft Word Microsoft Excel

Naeem U.

Profile

This work about data entry. am doing this work with best services.

Data entry Microsoft Excel

Qadir A.

Profile

I completed pdf to microsoft exel and microsoft world

PDF Microsoft Word Microsoft Excel

Mohammad N.

Profile